Bekijk de actuele crypto koersen

| Naam | Prijs | 24u (%) |

|---|---|---|

Bitcoin (BTC)

Bitcoin (BTC)

|

- | - |

Ethereum (ETH)

Ethereum (ETH)

|

- | - |

Ripple (XRP)

Ripple (XRP)

|

- | - |

Litecoin (LTC)

Litecoin (LTC)

|

- | - |

Bitcoin Cash (BCH)

Bitcoin Cash (BCH)

|

- | - |

Kies je bundel

Koop deze via iDeal of Bancontact en krijg direct toegang tot jouw portaal

Vertegenwoordigt 80% van de markt

Groeit mee met de markt

Automatisch balanceren

Automatisch reviseren

Vertegenwoordigt 70% van de markt

De bekendste cryptocurrencies

Het nieuwe goud

Automatisch balanceren

Meeliften op momentum van DeFi

Gespreide kansen en risico's

Automatisch balanceren

Automatisch reviseren

The sky is the limit

Kleine prijs stijging heeft groot effect

Automatisch balanceren

Automatisch reviseren

Voordelen van een bundel

Voordelen van een bundel

Diversificatie van risico

Het bezit van een bundel in plaats van een enkele cryptocurrency brengt stabiliteit in de volatiele cryptocurrency markt. Het verlaagt het risico van investeren in cryptocurrency. Een bundel zwakt alle pieken van elke afzonderlijke cryptocurrency af, zowel naar boven als naar beneden. Zelfs als een van de cryptocurrencies zakt naar 0 Euro, heeft dit een beperkt effect op de totale waarde van de bundel.

Bovenstaande bundel is in de periode van 2-11-2017 t/m 2-09-2018 25% in waarde gestegen doordat het profiteerde van de groei van XRP en IOTA.

Profiteer van alle groei

Vooraf is onbekend welke munten in waarde zullen stijgen of dalen, maar wanneer een cryptocurrency in je bundel opeens sterk stijgt in prijs, zal dit deel van je bundel ook sterk stijgen in waarde. Hierdoor neemt de waarde van je bundel als geheel toe.

Diversificatie van risico

Het bezit van een bundel in plaats van een enkele cryptocurrency brengt stabiliteit in de volatiele cryptocurrency markt. Het verlaagt het risico van investeren in cryptocurrency. Een bundel zwakt alle pieken van elke afzonderlijke cryptocurrency af, zowel naar boven als naar beneden. Zelfs als een van de cryptocurrencies zakt naar 0 Euro, heeft dit een beperkt effect op de totale waarde van de bundel.

Profiteer van alle groei!

Vooraf is onbekend welke munten in waarde zullen stijgen of dalen, maar wanneer een cryptocurrency in je bundel opeens sterk stijgt in prijs, zal dit deel van je bundel ook sterk stijgen in waarde. Hierdoor neemt de waarde van je bundel als geheel toe.

Jouw persoonlijke portaal

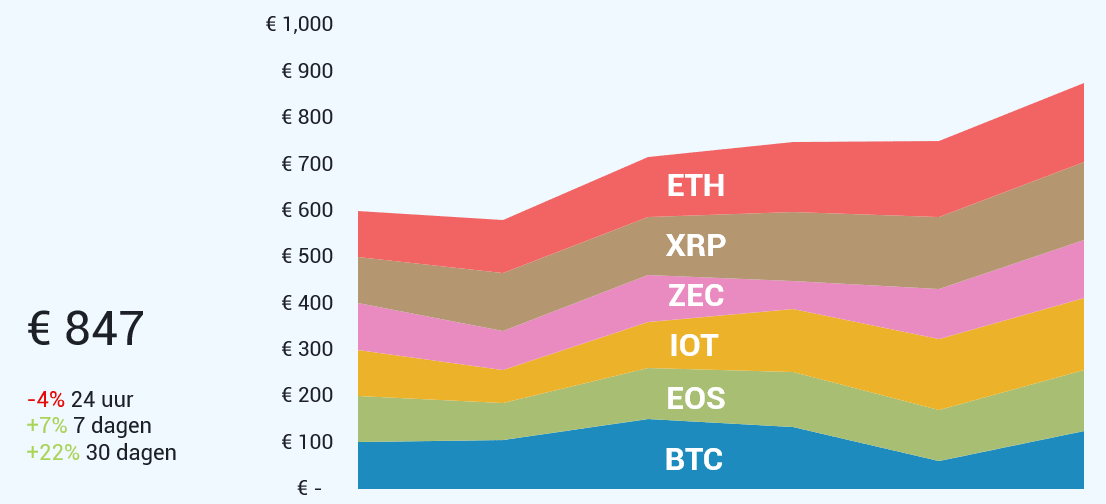

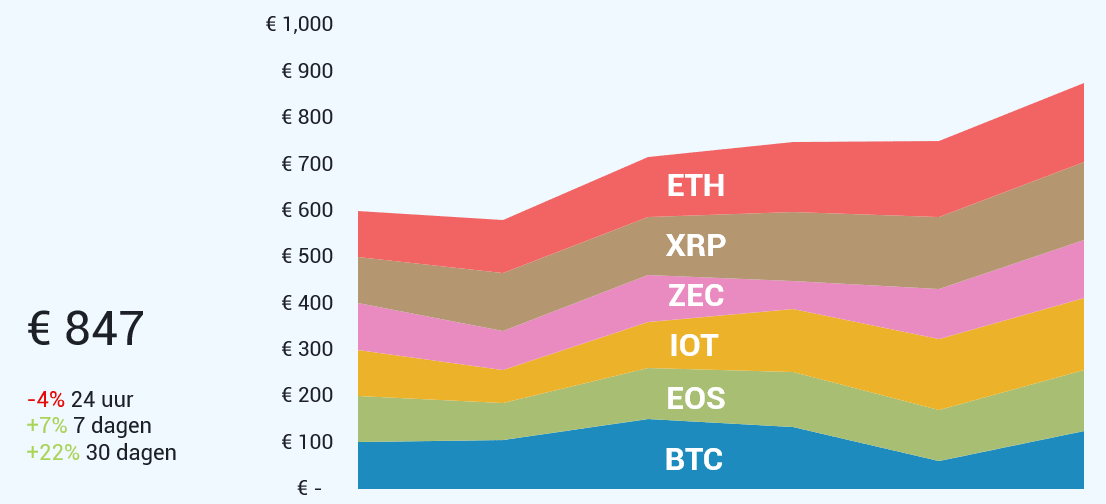

Real time inzage

Op je persoonlijke portal heb je op elk moment realtime inzicht in de waarde ontwikkeling van je bundel(s). De ontwikkeling per bundel zie je in een overzichtelijke grafiek die de waardeontwikkeling per munt laat zien. Als je meerdere bundels hebt kan je deze met elkaar vergelijken en direct ingrijpen wanneer nodig.

Jouw persoonlijke portaal

Real time inzage

Op je persoonlijke portal heb je op elk moment realtime inzicht in de waarde ontwikkeling van je bundel(s). De ontwikkeling per bundel zie je in een overzichtelijke grafiek die de waardeontwikkeling per munt laat zien. Als je meerdere bundels hebt kan je deze met elkaar vergelijken en direct ingrijpen wanneer nodig.

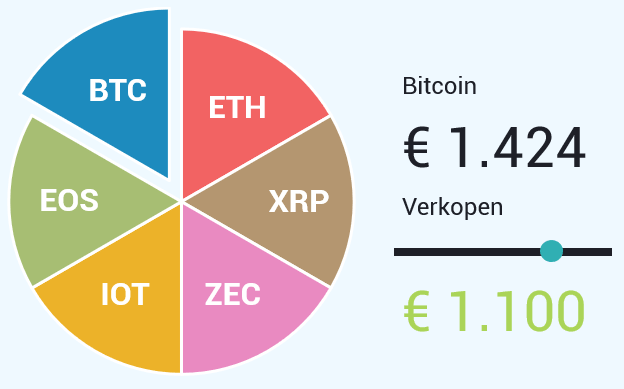

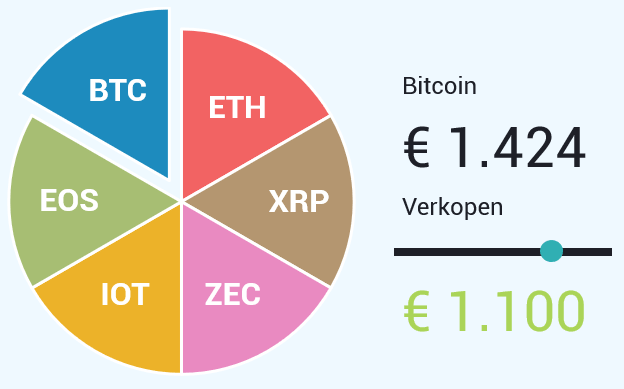

Onmiddelijk kopen of verkopen

Je persoonlijke portaal geeft je de mogelijkheid om op elk moment direct een gedeelte van je bundel te kopen of verkopen. Met handige sliders kan je aangeven dat je een deel van je bundel of zelfs specifieke munten wil verkopen naar Euro. Alle aanpassingen aan je bundel worden direct automatisch doorgevoerd op elk moment van de dag. Bij de keuze om Euro uit te laten keren wordt het bedrag binnen 5 werkdagen op je rekening gestort.

Onmiddelijk kopen of verkopen

Je persoonlijke portaal geeft je de mogelijkheid om op elk moment direct een gedeelte van je bundel te kopen of verkopen. Met handige sliders kan je aangeven dat je een deel van je bundel of zelfs specifieke munten wil verkopen naar Euro. Alle aanpassingen aan je bundel worden direct automatisch doorgevoerd op elk moment van de dag. Bij de keuze om Euro uit te laten keren wordt het bedrag binnen 5 werkdagen op je rekening gestort.

Automatisch beheer

Automatisch beheerd

Automatisch je bundel balanceren

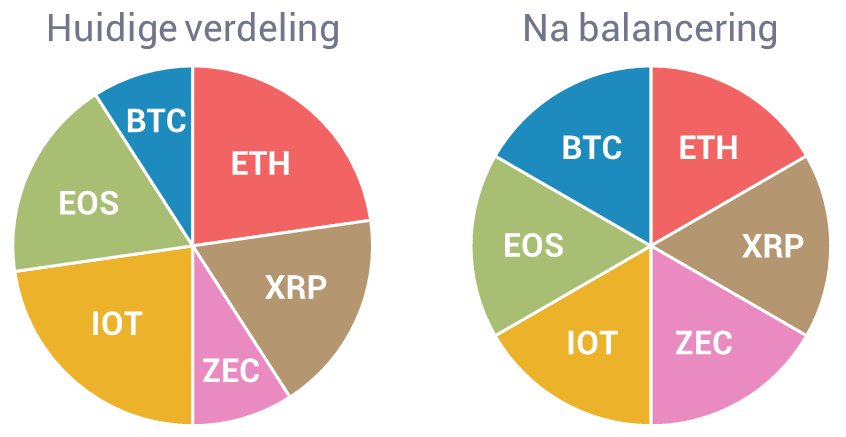

Na verloop van tijd verandert de verdeling van je bundel, bepaalde munten groeien en andere dalen in waarde. Om de werking van je bundel optimaal te houden kun je er voor kiezen om deze periodiek te balanceren. Je kunt elke keer je bundel handmatig balanceren via de balanceringstool in je persoonlijke portal of je kun het automatisch laten doen op een interval naar keuze. Tijdens het balanceerproces wordt een gedeelte van de munten die zijn gegroeid verkocht en worden de opbrengsten gebruikt om munten die gedaald zijn bij te kopen. Door periodiek te balanceren behoud je de verdeling in je bundel.

Automatisch reviseren

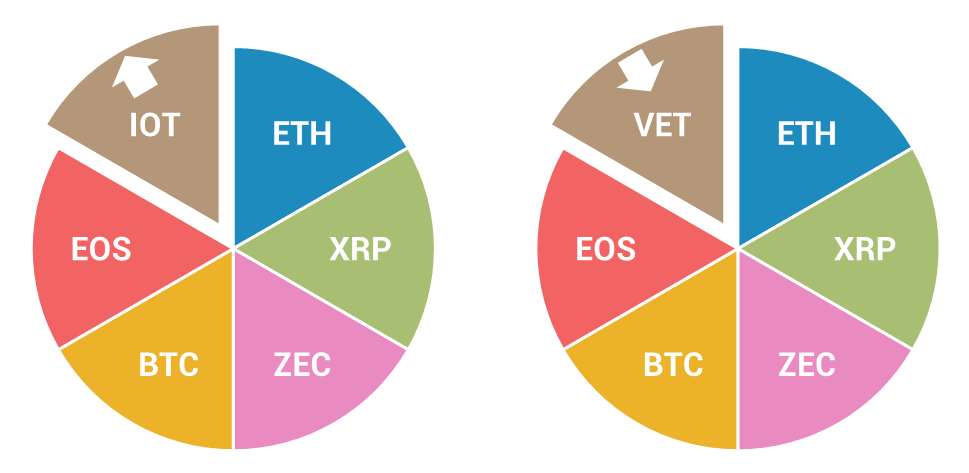

Een revisie van je bundel houdt in dat de tool een bepaalde cryptocurrency vervangt door een andere. Tijdens dit proces wordt alles van de munt die wordt vervangen verkocht, de opbrengsten van de verkoop worden gebruikt om de nieuwe cryptocurrency aan te schaffen. Een revisie van een bundel zorgt er voor dat de bundel altijd up-to-date is met de laatste ontwikkelingen in de markt. Door regelmatig te reviseren weet je zeker dat je munten hebt die voldoen aan je oorspronkelijke plan en dat er geen munten in je bundel blijven die langzaam uit beeld verdwijnen.

Automatisch je bundel balanceren

Na verloop van tijd verandert de verdeling van je bundel, bepaalde munten groeien en andere dalen in waarde. Om de werking van je bundel optimaal te houden kan je er voor kiezen om deze periodiek te balanceren. Je kan elke keer je bundel handmatig balanceren via de balanceringstool in je persoonlijke portal of je kan het automatisch laten doen op een interval naar keuze. Tijdens het balanceerproces wordt een gedeelte van de munten die zijn gegroeid verkocht en worden de opbrengsten gebruikt om munten die gedaald zijn bij te kopen. Door periodiek te balanceren behoudt je de verdeling in je bundel.

Automatisch reviseren

Een revisie van je bundel houdt in dat de tool een bepaalde cryptocurrency vervangt voor een andere. Tijdens dit proces wordt alles van de munt die wordt vervangen verkocht, de opbrengsten van de verkoop worden gebruikt om de nieuwe cryptocurrency aan te schaffen. Een revisie van een bundel zorgt er voor dat de bundel altijd up to date is met de laatste ontwikkelingen in de markt. Door regelmatig te reviseren weet je zeker dat je munten hebt die voldoen aan je oorspronkelijke plan en dat er geen munten zijn in je bundel blijven die langzaam uit beeld verdwijnen.

Automatisch je bundel balanceren

Na verloop van tijd verandert de verdeling van je bundel, bepaalde munten groeien en andere dalen in waarde. Om de werking van je bundel optimaal te houden kan je er voor kiezen om deze periodiek te balanceren. Je kan elke keer je bundel handmatig balanceren via de balanceringstool in je persoonlijke portal of je kan het automatisch laten doen op een interval naar keuze. Tijdens het balanceerproces wordt een gedeelte van de munten die zijn gegroeid verkocht en worden de opbrengsten gebruikt om munten die gedaald zijn bij te kopen. Door periodiek te balanceren behoudt je de verdeling in je bundel.

Automatisch reviseren

Een revisie van je bundel houdt in dat de tool een bepaalde cryptocurrency vervangt voor een andere. Tijdens dit proces wordt alles van de munt die wordt vervangen verkocht, de opbrengsten van de verkoop worden gebruikt om de nieuwe cryptocurrency aan te schaffen. Een revisie van een bundel zorgt er voor dat de bundel altijd up to date is met de laatste ontwikkelingen in de markt. Door regelmatig te reviseren weet je zeker dat je munten hebt die voldoen aan je oorspronkelijke plan en dat er geen munten zijn in je bundel blijven die langzaam uit beeld verdwijnen.

Veiligheid

Triaconta heeft de nodige ervaring in het werken met en handelen in cryptocurrencies. Triaconta heeft diverse processen geïmplementeerd die de veiligheid van zijn gebruikers waarborgen.

Klanten waarderen onze dienstverlening met een 9,3!

Cryptocurrencies worden zoveel mogelijk opgeslagen in cold-storage om veiligheid te waarborgen. Daarnaast wordt alle persoonlijke data veilig opgeslagen door middel van encryptie.

Elke aan- en verkoop moet worden bevestigd via e-mail. Op deze manier kan alleen jij transacties uitvoeren en ben je direct op de hoogte als er zich vreemde transacties voordoen op je account.

Triaconta voldoet aan alle, vanuit de overheid geldende, richtlijnen zoals KYC/AML en de nieuwe AVG wetgeving.